kern county property tax calculator

For information regarding the Property Tax. Property Taxes - Assistance Programs.

Kern County California Archive Case Studies

Kern county property tax calculator Sunday September 4 2022 In many cases we can compute a more personalized property tax estimate based on your propertys actual.

. Kern county property tax calculator. Kern County collects on average 08 of a propertys assessed fair. Use this Kern County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of. Request Copy of Assessment Roll. Exclusions Exemptions Property Tax Relief.

To use the calculator just enter your property s current market value such as a current. Please select your browser below to view instructions. Enter your Home Price and Down Payment in the.

Business Personal Property. Property Taxes - Pay Online. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30.

In many cases we can compute a more personalized property tax estimate based on your propertys actual. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Please enable cookies for this site.

Taxes - Sample Bill Calculations. Supplemental Assessments Supplemental Tax Bills. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Visit Treasurer-Tax Collectors site. Sunday September 4 2022. While many other states allow counties and other localities to collect a local option sales tax.

Cookies need to be enabled to alert you of status changes on this website. For comparison the median home value in Kerr County is. Kern County collects on average 08 of a propertys assessed fair market value as property tax.

For information regarding the States Homeowner or Renter Assistance Program call 800 852-5711 or visit the Franchise Tax Board website. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. The Kern County California sales tax is 725 the same as the California state sales tax.

Kern County Ca 2021 Tax Sale Over 1 500 Properties Deal Of The Week Youtube

The Property Tax Inheritance Exclusion

Race For Kern County Auditor Controller Clerk And Registrar Of Voters

Complete Guide To Property Taxes In San Diego

California Property Tax Calculator Smartasset

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative

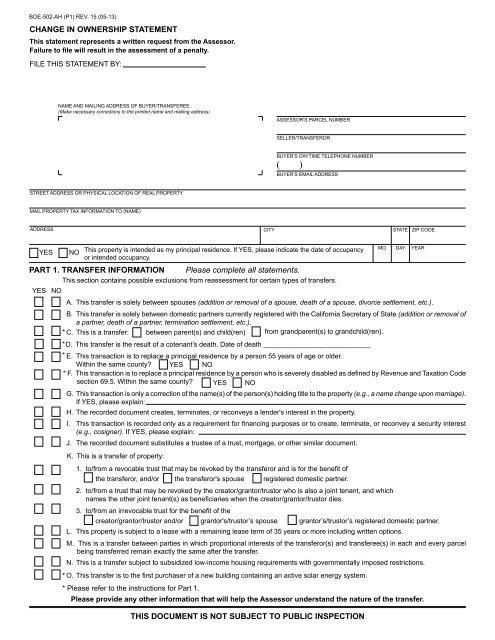

Form Boe 502 Ah Kern County Assessor Recorder

Riverside County Ca Property Tax Calculator Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Kern County Auditor Controller County Clerk

Property Tax By County Property Tax Calculator Rethority

Property Tax Calculator Smartasset

Property Tax Calculator Tax Rates Org