german tax calculator in english

You can enter your details on Zasta for free and you will get a pre-calculated tax return offer from a. You are required to file a tax return.

German Wage Tax Calculator Expat Tax

German Wage Tax Calculator Expat Tax.

. You will most likely get a very high tax refund. If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. Also known as Gross Income.

Rental income from German sources of one spouse totals a loss of EUR 5000. The SteuerGo Gross Net Calculator lets you determine your net income. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

Hundreds of thousands of satisfied customers. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. To calculate the German income tax you owe on your wages you can use the SteuerGo tax calculator.

Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence. This is a sample tax calculation for the year 2021. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag.

Further tips and instruction. Just do your tax return with SteuerGo. Zasta is a different kind of tax software as it serves as a platform to connect you to a professional tax advisor.

Zasta translated by Google. Easy-to-use also without tax-knowledge. A tax of up to 55 per cent which was introduced to pay for the German Reunion.

The German Annual Income Tax Calculator for the 2022. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. EUR 1999 in case of short-time work Kurzarbeit or unemployment in 2020.

Tax Calculator in Germany. Try it for free. Take-Home Pay in Germany Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis. Salary Before Tax your total earnings before any taxes have been deducted. Income more than 58597 euros gets taxed with the highest income tax rate of 42.

The so-called rich tax Reichensteuer of 45. What taxes and charges are withheld from wages in Germany year 2022. It is a progressive tax ranging from 14 to 42.

Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. No employment related expenses exceeding the lump sum allowance of EUR 1000. Gross salary of one spouse of EUR 100000 other spouse has no income.

You can enter the gross wage as an annual or monthly figure. The calculator covers the new tax rates 2022. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

For a final view on German taxes we kindly ask you to. EinkommensteuerESt Lohnsteuer - 14-45 see the tax rates below on the page. Youll then get a breakdown of your total tax liability and take-home pay.

Glossary The different Tax Categories of the German Wage Tax system. The promise at the time was that this extra tax would last only 5 years. Married couple with two dependent children under age 18 years.

Kirchensteuer - 8-9 from ESt - if a person belongs to one of the churches that collect taxes from believers for example the Catholic church. Filing your tax return is worth it. Not surprinsingly it is nearly impossible to calculate your taxes in Germany manually.

Personal income tax Ger. Now its 24 years later and the tax is still alive and kicking How to calculate your taxes in Germany. Millions of euros in tax refunds for.

Please note that this application is only a simplistic tool. If you only have income as self employed from a trade or from a rental property you will get a more accurate. You can expect a high tax refund.

Personal tax allowance and deductions in Germany Making the most of the tax allowances and deductions available increases your chances of getting a tax refund.

German Income Tax Calculator Expat Tax

Crypto Staking Taxes Ultimate Guide Koinly

Income Tax In Germany For Expat Employees Expatica

Capital Gains Tax Calculator Ey Global

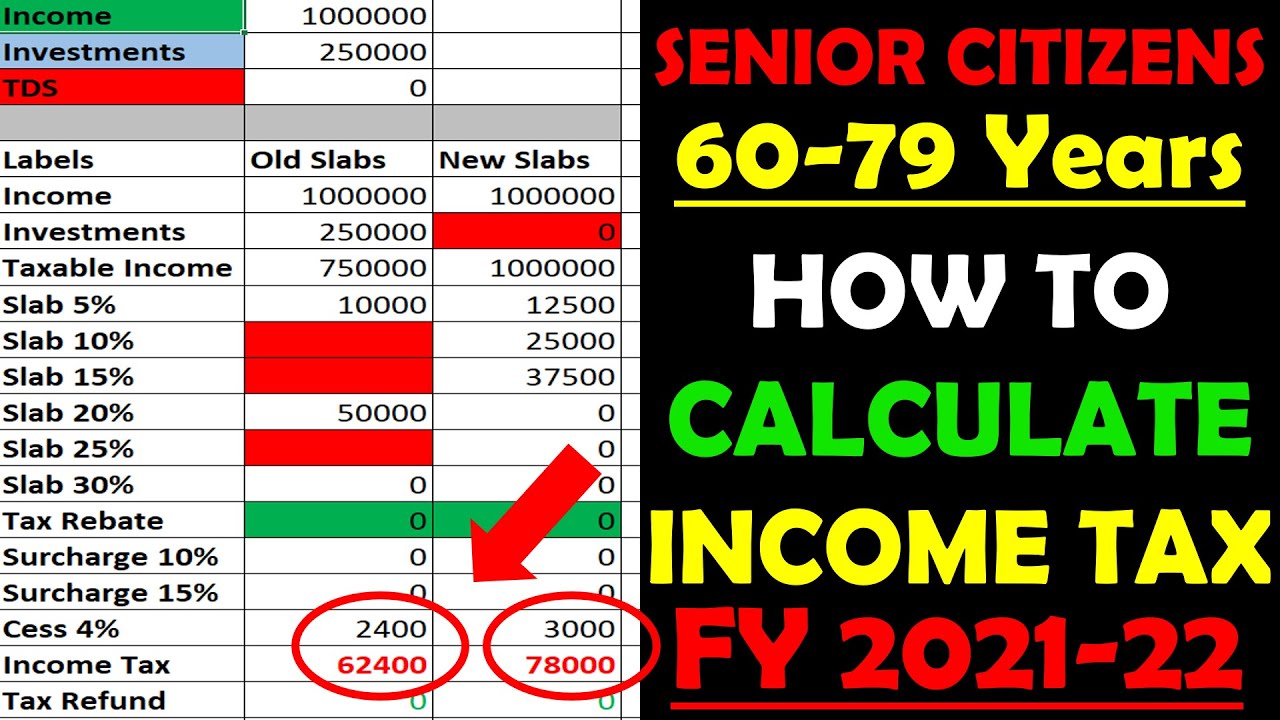

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

Personal Income Tax Solution For Expatriates Mercer

Personal Income Tax Solution For Expatriates Mercer

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

How To Create An Income Tax Calculator In Excel Youtube

German Tax Calculator Easily Work Out Your Net Salary Youtube

How To Calculate Foreigner S Income Tax In China China Admissions

How To Create An Income Tax Calculator In Excel Youtube

Download Income Tax Calculator Fy 2021 22 Ay 2022 23 Income Tax Income File Income Tax

German Vat Calculator Vatcalculator Eu

Personal Income Tax Solution For Expatriates Mercer

German Income Tax Calculator Expat Tax

Canon Dk 1000i Ii Usb Portable Numeric Keypad Calculator W Trackball By Canon 19 99 Canon Dk 1000i Ii Usb 12 Numeric Keypad Desktop Calculator Calculator

How To Calculate Foreigner S Income Tax In China China Admissions