tax shield formula apv

Using the APV Method. Interest Tax Shield Formula.

Adjusted Present Value Apv Formula And Excel Calculator

Under the cost-sharing formula Oxys share of the annual retiree medical plan cost increase is limited to the Consumer Price Index CPI.

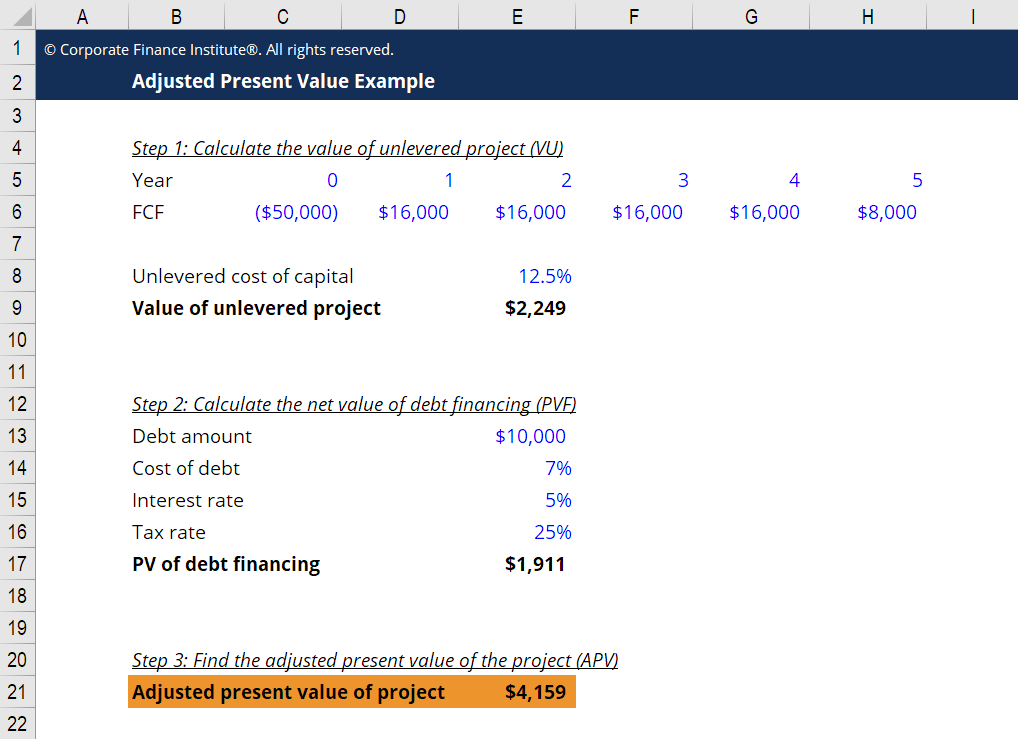

. Present Value of Cash Flows formula and calculations. The APV method is not used as frequently in practice as is the DCF analysis but more in academic circles. PV of Tax Shield 1050m0303170-0909 2.

The discount rate used in the second part is the cost of debt financing by period. Now that we have worked out all the intermediate calculations we can calculate adjusted present value as follows. Its important to understand exactly how the NPV formula works in Excel and the math behind it.

APV base-case NPV sum of PVs of financing side effects. PV of Cash Flows Cash Flow Risk RateAsset Beta Market Return - Risk Rate - Project Cost. In particular use of this approach effectively assumes that the company is not expected to grow which of course.

PV if Tax Shield 1050m24m0303170-0909. This reduces the tax it needs to pay by 280000. Tax Shield Formula Step By Calculation With Examples.

Interest Tax Shield Interest Expense x Tax Rate. Present Value of Tax Shield Interest Expense Debt Rate Tax Rate Adjusted Present Value APV PV of Cash Flows Present Value of Tax Shield. This is equivalent to the 800000 interest expense multiplied by 35.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Where CF - Cash Flow PC - Project Cost MR - Market Return RR - Risk Rate AB - Asset Beta IE - Interest Expense DR - Debt Rate TR - Tax Rate PVCF - PV of Cash Flows PVTS - Present Value of Tax Shield APV - Adjusted Present Value. The present value of the interest tax shield for the period from 19891993 can be calcu-lated by discounting the annual tax savings at the pretax average cost of debt which was approximately 135 percent.

The Adjusted Present Value APV is a good calculation to use when appraising a potential investment. Issue cost 24m Amount of loan 50 m Normal borrowing rate 10 for 4 yrs Tax 30. It is the present value of an investment with some modifications.

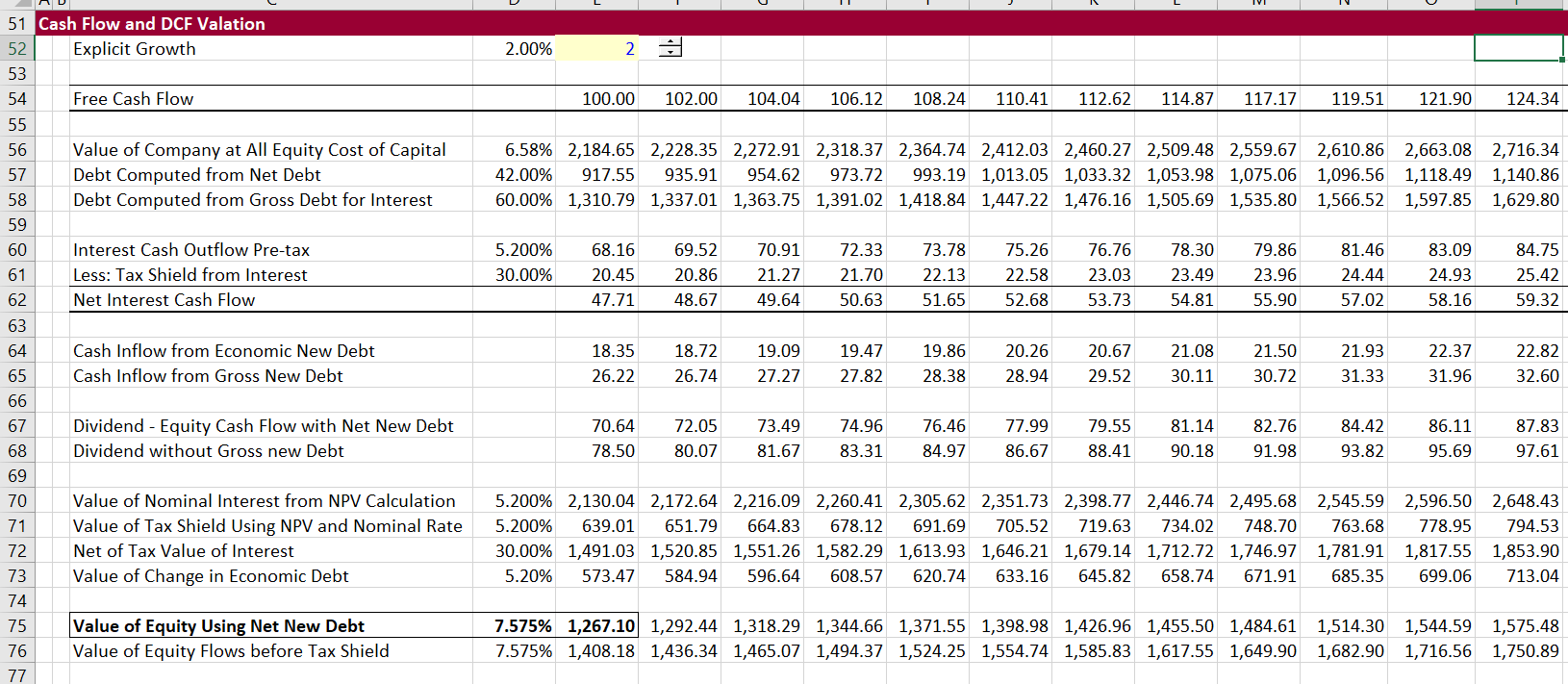

APV formula APV Unlevered NPV of Free Cash Flows and assumed Terminal Value NPV of Interest Tax Shield and assumed Terminal Value. As we know higher debt offers a higher tax shield which in turn increases both firm value and equity value. DE Current debtequity ratio.

Based on the information do the calculation of the tax shield enjoyed by the company. Accept positive APV projects and reject negative APV projects. Using the tax shields from Table 17A2 the discounted value of these tax shields is calculated as.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. Discount the FCF using the weighted average of after-tax debt costs and equity costs Adjusted Present Value APV. The Present Value of Tax Shield pv ts is.

Adjusted Present Value Apv Definition Explanation Examples. To explicitly account for the debt tax shield the Adjusted Present Value APV method is used. Plus the present value of debt financing costs.

However the APV is often considered to yield a more accurate valuation. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. Tax rate debt load interest rate interest rate.

In we have a cash flow to the firm of and an absolute tax shield value of. Debt And Taxes Chapter 15 In. Apv Adjusted Present Value Overview Components Steps.

Cash Flow After Deprecition And Tax 2 Depreciation Shield You. Pv ts e tcod pv ts pv ts pv ts pv ts. Expected Tax Benefit from Borrowing The second step in this approach is the calculation of the expected tax benefit from a given level of debt.

We therefore assume that the firms WACC is 15 the borrowing rate is given above. And stand for debt and equity of the firm and are the required return rates for debt and equity is the marginal tax rate. NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future.

The use of the MM formula 2 for the debt tax shield is a special case of the APV approach that makes somewhat restrictive assumptions about the level and risk of the debt tax shield. APV values the firm without leverage and then values the debt tax shields to determine the value of the whole firm. APV PVCF PVTS.

The discount rate used in the first part is the return on assets or return on equity if unlevered. As such the shield is 8000000 x 10 x 35 280000. How to Calculate Adjusted Present Value APV To determine the.

T Tax rate for the firm. The formula includes that comes from tax shield savings. Thereby the APV approach allows us to see whether adding more debt results in a tangible increase or decrease in value as well as enables us to quantify the effects of debt.

Value the project as if it were all-equity financed Add the PV of the tax shield of debt and other side effects D E E k D E D D WACC k 1 t E. For 2011 the federal drug subsidy again helped hold the line on contributions so even though overall costs con-tinue to increase at double-digit rates retiree medical contributions will increase by. When calculating for the present value of Tax shield and subsidy benefit on a loan does one has to add the issue cost of the loan to the amount of loan.

Exercise 17 After Tax Cash Flows In Net Present Value Ysis Accounting For Management. APV NPV L PV D 1061 million 10 million 2061 million Decision rule The decision rule for adjusted present value is the same as net present value. The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

We consider one time period starting at and ending at time. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC. The Adjusted Present Value apv is.

Pv cf cfr a mr - r100 - pc - 100 - 100 - 100 - - - pv cf Present Value of Tax Shield formula and calculations. _____ 1151 1135 1021 _____ 11352 1058. This unlevered beta can then be used to arrive at the unlevered cost of equity.

The present value of the interest tax shield is therefore calculated as.

Lecture 09 Valuation Berk De Marzo Chapter 18 Pdf Free Download

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Capital Budgeting And Valuation With Leverage Ppt Video Online Download

Capital Budgeting And Valuation With Leverage Ppt Video Online Download

Apv Adjusted Present Value Overview Components Steps

Adjusted Present Value Apv Formula And Excel Calculator

Materi Ke 5 Financial Management Bagian Ii Kelas Ap 1 Ppt Download

Using Apv A Better Tool For Valuing Operations Cost Accounting Finance Operator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Ppt Corporate Finance Financing And Valuation Powerpoint Presentation Id 540390

Adjusted Present Value Apv Formula And Excel Calculator

Capital Budgeting Considering Risk And Leverage Ppt Download

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Ppt Chapter 21 Powerpoint Presentation Free Download Id 4710282

Lecture 09 Valuation Berk De Marzo Chapter 18 Pdf Free Download

Adjusted Present Value Apv Definition Explanation Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance